RoosterMoney is designed to answer one question: How do I as a parent teach my children the same values I learned as a child?

In this post, I want to talk a little about the motivations behind why we have built RoosterMoney and the problems we are trying to address.

We are becoming a cashless society

Gone are the days that children run down to the local sweet shop to spend their pennies. We are running towards becoming a cashless society.

This offers some exciting opportunities for us all. Contactless cards, which means no more forgotten pins; transferring cash across the globe without logging into a bank (or facing its charges); peer to peer payments via my social network so I get money quickly and easily.

In some countries like India many now have their first payment experience through mobile, not physical cash. Leap frogging our own experiences in Europe.

Technology is driving much of this and our earliest adopters are also often our youngest. In the UK, research completed last year by Dubit showed 85% of children between the age of 2 and 15 have access to a tablet computer. By the age of 8, many children have a smartphone and that number is increasing.

This means that a child’s exposure to money via online products and in app purchases, digital magazines and games is getting younger. And those products are getting more sophisticated in their monetisation strategies. Take Skylanders or Disney Infinity for example, both you can buy the video game, then you buy the additional bolt on packs and then you are encouraged to buy the physical merchandise: Merchandising is big business.

And if we as adults are paying for things by card, then that means less cash in circulation in the household for kids to handle.

Learning about money should be a family affair

The increasingly intangible nature of money and this exposure at a younger age means that families are having conversations about money earlier than they may have previously been. This is both an opportunity and a challenge for anyone who wants to teach the basics of money management.

While there is a very positive move to put financial literacy firmly on the curriculum, we believe that the best vehicle for teaching the value of money is the family unit. Families can make it contextual to their personal circumstances and relevant – teaching those lessons at the kitchen table, when the utility bill comes in or indeed budgeting for the supermarket shop. But that needs support.

Getting into a pocket money routine can be tough

Before we began building RoosterMoney parents were unanimous on the fact that while they love the idea of giving pocket money, finding a solution that is easy to manage is hard. Getting into a routine is especially difficult. Reward charts, marbles, house rules, set chores, weekly pocket money that you need to remember to give. Yet it is that routine or framework that allows parents to start instilling those money habits early on.

Research suggests that 40% of what we do every day is down to habit. For some of us, that might be opening the fridge when we walk into the kitchen. But those habits can also be positive ones – whether we say please or thank you; whether we open doors for others. Or indeed whether we know what the value of the money we are spending is.

In fact many of the basic money habits we have formed are defined by the age of Seven, such as understanding what “value” is, that there is an opportunity cost (if we buy one thing it will be at the expense of another thing you might be saving for) and that you need to save some of what you get. Cement those habits early on and they will stay with you for life.

So how do we begin addressing these issues?

The Jam Jar doesn't cut it any more

From a practical as well as educational point of view, the Jar Jar doesn’t cut it anymore (indeed if it ever did). We need a way to make money and numbers tangible whilst making it digital and relevant. And Jars aren’t mobile, they also don’t have location finders and while you can gamify a Jam Jar through rewards, children are now dealing in digital currency.

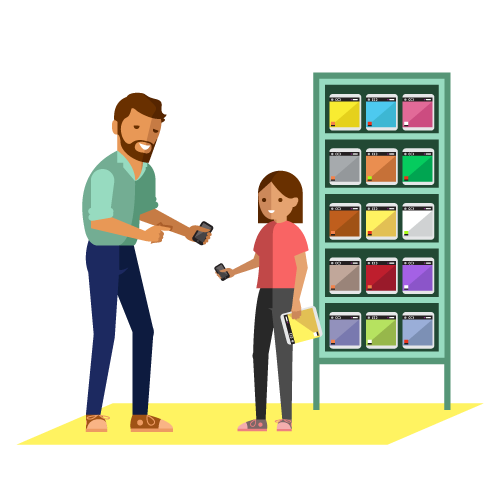

Conversations (and indeed arguments) about money don’t necessarily happen in the kitchen, they happen at the shops or on the school run. The solution has to be mobile and it has to be accessible to the whole family. Mum, Dad, children, gran and grandad all need access.

Creating space to talk about money

Every family manages pocket money in different ways too: Some parents want to set an allowance, others want to award money for jobs; some don’t want to use money but Stars instead.

In addition to needing something digital and relevant we also need something that is flexible to each families’ needs. We don’t want to tell parents how to teach their children the value of money. What we do want to do is provide a framework that addresses the pain points of managing and keeping track of pocket money in a digital age, whilst encouraging families to find space to talk about money. Whether that’s at home or in the shops or indeed on a day out with Gran.

Building good money habits early on

RoosterMoney is designed to help engage kids in positive money habits by helping families get into routines. We encourage conversations or provoke them in the right situation. We then encourage an action: this could be the child allocating their money to a Goal or putting it into their Save pot or asking to get something in the shops. And we reward them, whether that’s celebrating a goal achieved or reaching a Saving milestone. By repeating that process we reinforce habit, making sure that the lessons kids learn stick and those habits are there for life.

RoosterMoney is free to sign up to. Give it a try and let us know what you think!